Types of Investments-There are various types of investments that people use to invest to earn more for example stocks, bonds, mutual funds, index funds, exchange-traded funds (ETFs), and options. You can see here in this post on our best blog- money08.com which ones might work for you.

As an investor, you have a lot of options for where to put your money. It’s important to know the types of investments carefully.

Investments are generally bucketed into three major categories: stocks, bonds, and cash equivalents. There are many different types of investments within each bucket.

Here are many types of investments you might consider for long-term growth, and what you should know about each.

What are the types of investments?

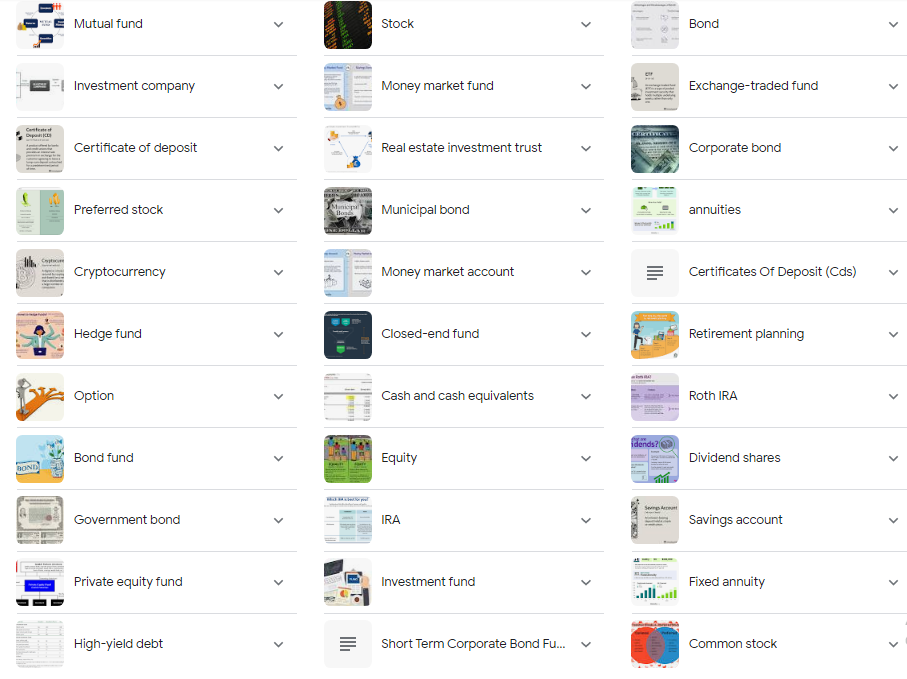

As per search you can see there are many types of Investments-

- Mutual fund

- Stock

- Bond

- Investment company

- Money market fund

- Exchange-traded fund

- Certificate of deposit

- Real estate investment trust

- Corporate bond

- Preferred stock

- Municipal bond

- annuities

- Cryptocurrency

- Money market account

- Certificates Of Deposit (Cds)

- Hedge fund

- Closed-end fund

- Retirement planning

- Option

- Cash and cash equivalents

- Roth IRA

- Bond fund

- Equity

- Dividend shares

- Government bond

- IRA

- Savings account

- Private equity fund

- Investment fund

- Fixed annuity

- High-yield debt

- Short-Term Corporate Bond Funds

- Common stock

What are the types of best investments in the USA?

These are the best types of investment in the USA-

- Stocks

- Bonds

- Mutual funds

- Index funds

- Exchange-traded funds (ETFs)

- Options

- Certificates of deposits

- Retirement plans

- Annuities

- Cryptocurrency

- commodities

What are the types of best investments in India?

These are the best investment types in India-

- Stock and equities

- Debt mutual funds

- Fixed deposits

- Bonds

- Provident funds

- Real estate

- Certificates of deposit

- Retirement plan

- Cryptocurrencies

- Commodities

So below is a detailed description of the best investment in the USA and India

Stocks

First is stock, I am sure you know that a stock is an investment in a specific company. When you purchase a stock, you’re buying a share as a small piece of that company’s earnings and assets. Companies sell shares of stock in their businesses to raise cash; investors can then buy and sell those shares among themselves. Stocks sometimes earn high returns but also come with more risk than other investments. Companies can lose value or go out of business.

Why the stock is the best option to invest in?

It is one of the best options to invest because stock investors make money when the value of the stock they own goes up and they’re able to sell that stock for a profit. Some stocks also pay dividends, which are regular distributions of a company’s earnings to investors. Here the profit & loss will depend on the sale of shares at the upper and lower rate of shares.

Bonds

Second, the best investment is a bond which is a loan you make to a company or government. When you purchase a bond, you’re allowing the bond issuer to borrow your money and pay you back with interest.

Bonds are generally considered less risky than stocks, but they also may offer lower returns. The primary risk, as with any loan, is that the issuer could default. U.S. government bonds are backed by the “full faith and credit” of the United States, which effectively eliminates that risk. State and city government bonds are generally considered the next-less-risky option, followed by corporate bonds. Generally, the less risky the bond, the lower the interest rate. For more details, read our introduction to bonds.

Why the bond is the best option to invest in?

Bonds are a fixed-income investment because investors expect regular income payments. Interest is generally paid to investors in regular installments typically once or twice a year and the total principal is paid off at the bond’s maturity date.

Mutual funds

The third investment is mutual funds If the idea of picking and choosing individual bonds and stocks isn’t your bag, you’re not alone. In fact, there’s an investment designed just for people like you: the mutual fund.

Mutual funds allow investors to purchase a large number of investments in a single transaction. These funds pool money from many investors, then employ a professional manager to invest that money in stocks, bonds, or other assets.

Mutual funds follow a set strategy a fund might invest in a specific type of stock or bond, like international stocks or government bonds. Some funds invest in both stocks and bonds. How risky the mutual fund is will depend on the investments within the fund.

Why a mutual fund is the best option to invest in?

When you will earn money from a mutual fund- for example, through stock dividends or bond interest it distributes a proportion of that to investors. When investments in the fund go up in value, the value of the fund increases as well, which means you could sell it for a profit. Note that you’ll pay an annual fee, called an expense ratio, to invest in a mutual fund.

Index funds

Forth an index fund is a type of mutual fund that passively tracks an index, rather than paying a manager to pick and choose investments. For example, an S&P 500 index fund will aim to mirror the performance of the S&P 500 by holding the stock of the companies within that index.

The benefit of index funds is that they tend to cost less because they don’t have that active manager on the payroll. The risk associated with an index fund will depend on the investments within the fund. Learn more about index funds.

Why the index fund is the best option to invest in?

Index funds may earn dividends or interest, which is distributed to investors. These funds may also go up in value when the benchmark indexes they track go up in value; investors can then sell their share in the fund for a profit. Index funds also charge expense ratios, but as noted above, these costs tend to be lower than mutual fund fees.

Exchange-traded funds

Fifth, ETFs are a type of index fund: They track a benchmark index and aim to mirror that index’s performance. Like index funds, they tend to be cheaper than mutual funds because they are not actively managed.

The major difference between index funds and ETFs is how ETFs are purchased: They trade on an exchange like a stock, which means you can buy and sell ETFs throughout the day and an ETF’s price will fluctuate throughout the day. Mutual funds and index funds, on the other hand, are priced once at the end of each trading day — that price will be the same no matter what time you buy or sell. Bottom line: This difference doesn’t matter to many investors, but if you want more control over the price of the fund, you might prefer an ETF. Here’s more about ETFs.

Why the exchange-traded fund is the best option to invest in?

As with a mutual fund and an index fund, your hope as an investor is that the fund will increase in value and you’ll be able to sell it for a profit. ETFs may also pay out dividends and interest to investors.

Options

Sixth, An option is a contract to buy or sell a stock at a set price, by a set date. Options offer flexibility, as the contract doesn’t actually obligate you to buy or sell the stock. As the name implies, doing so is an option. Most options contracts are for 100 shares of stock.

When you buy an option, you’re buying the contract, not the stock itself. You can then either buy or sell the stock at the agreed-upon price within the agreed-upon time; sell the options contract to another investor; or let the contract expire. Here’s more about how options work.

Why the options stock is the best option to invest in?

Options can be quite complex, but at a basic level, you are locking in the price of a stock you expect to increase in value. If your crystal ball is right, you benefit by purchasing the stock for less than the going rate. If it is wrong, you can forgo the purchase and you’re only out the cost of the contract itself.

Certificates of Deposit (CDs)

Seventh, A certificate of deposit (CD) is a very low-risk investment. You give a bank a certain amount of money for a predetermined amount of time. When that time period is over, you get your principal back, plus a predetermined amount of interest. The longer the loan period, the higher your interest rate.

Why are the Certificates of Deposit the best option to invest in?

CDs are good long-term investments for saving money. There are no major risks because they are FDIC-insured up to $250,000, which would cover your money even if your bank were to collapse. That said, you have to make sure you won’t need the money during the term of the CD, as there are major penalties for early withdrawals.

Retirement Plans

Next is Retirement plans, There are a number of types of retirement plans. Workplace retirement plans, sponsored by your employer, include 401(k) plans and 403(b) plans. If you don’t have access to a retirement plan, you could get an individual retirement plan (IRA), of either the traditional or Roth variety.

Why is Retirement plans the best option to invest in?

Retirement plans aren’t a separate category of investment, per se, but a vehicle to buy stocks, bonds, and funds in two tax-advantaged ways. The first, lets you invest pretax dollars (as with a traditional IRA). The second, allows you to withdraw money without paying taxes on that money. The risks for the investments are the same as if you were buying the investments outside of a retirement plan.

Annuities

Next are the annuities Many people use annuities as part of their retirement savings plan. When you buy an annuity, you purchase an insurance policy and, in return, you get periodic payments.

Annuities come in numerous varieties. They may last until death or only for a predetermined period of time. They may require periodic premium payments or just one up-front payment. And they may link partially to the stock market or they may simply be an insurance policy with no direct link to the markets. Payments may be immediate or deferred to a specified date. They may be fixed or variable.

Why are Annuities the best option to invest in?

Annuities can guarantee an additional stream of income for retirement. But while they are fairly low risk, they aren’t high-growth. So investors tend to make them a good supplement for their retirement savings, rather than an integral source of funding.

Cryptocurrencies

Next is Cryptocurrencies which are a fairly new investment option. Bitcoin is the most famous cryptocurrency, but there are countless others, such as Litecoin and Ethereum. These are digital currencies that don’t have any government backing. You can buy and sell them on cryptocurrency exchanges. Some retailers will even let you make purchases with them.

Why are cryptocurrencies the best option to invest in?

Cryptos often have wild fluctuations, making them a very risky investment. However, some investors use them as alternative investments to diversify their portfolios beyond stocks and bonds. You can get them at cryptocurrency exchanges.

Commodities

Commodities are physical products that you can invest in. They are common in futures markets where producers and commercial buyers – in other words, professionals – seek to hedge their financial stake in the commodities.

Retail investors should make sure they thoroughly understand futures before investing in them. Partly, that’s because commodities investing runs the risk that the price of a commodity will move sharply and abruptly in either direction due to sudden events. For instance, political actions can greatly change the value of something like oil, while the weather can impact the value of agricultural products.

Here’s a breakdown of the four main types of commodities:

- Metals: precious metals (gold and silver) and industrial metals (copper)

- Agricultural: Wheat, corn, and soybeans

- Livestock: Pork bellies and feeder cattle

- Energy: Crude oil, petroleum products, and natural gas

Why are the Commodities the best option to invest in?

Investors sometimes buy commodities as a hedge for their portfolios during inflation. You can buy commodities indirectly through stocks and mutual funds, or ETFs and futures contracts.

Where to purchase different types of investments?

No matter what you invest in, you’ll need a brokerage account. Unlike a bank account, a brokerage account allows you to buy and sell investments.

You can open a brokerage account in as little as 15 minutes, and once funded, you’ll be ready to begin investing. The broker’s website will have tools to help you find the investments you want, and many also provide educational resources to get you started. Read our full guide for more on how and where to open a brokerage account.

5 comments

Comments are closed.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!